Ujjivan Small Finance Bank Ltd. (Multibagger) ये शेयर आगे जाकर बनेगा Multibagger यहाँ पूरी जानकारी|

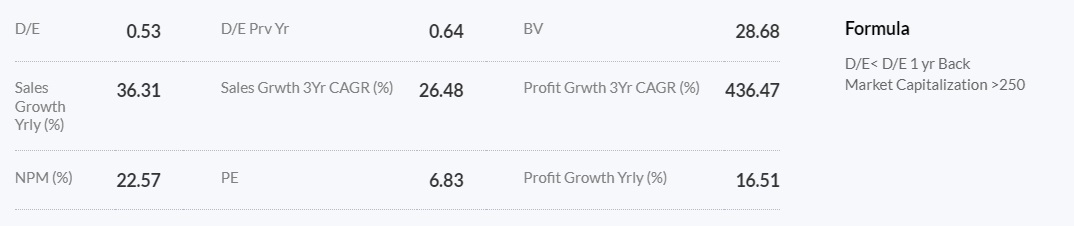

Decreasing Debt To Equity

Companies decreasing their Debt to Equity ratio

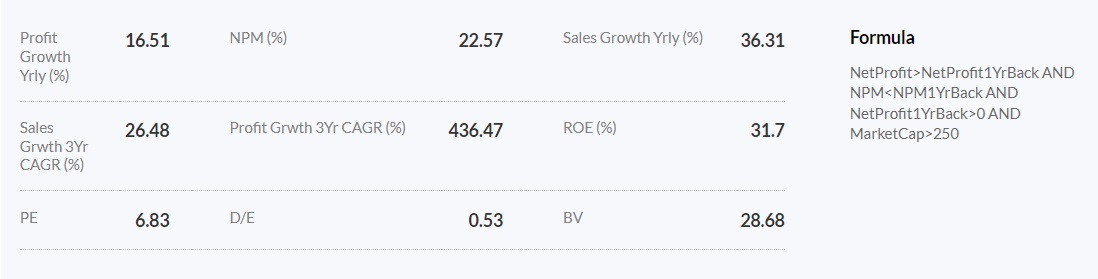

बढ़ता मुनाफा, घटता मार्जिन |Rising Profits, Falling Margins

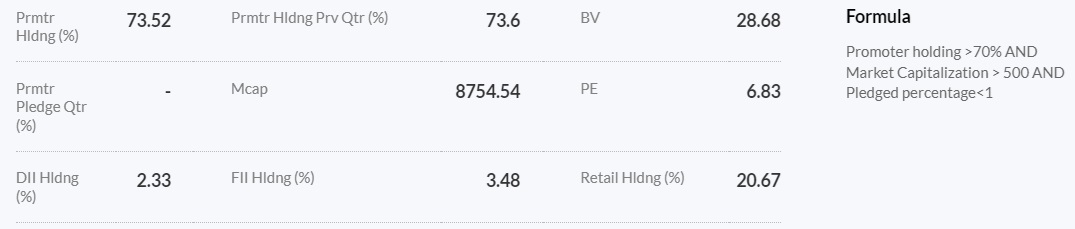

उच्च प्रमोटर होल्डिंग | High Promoter Holding

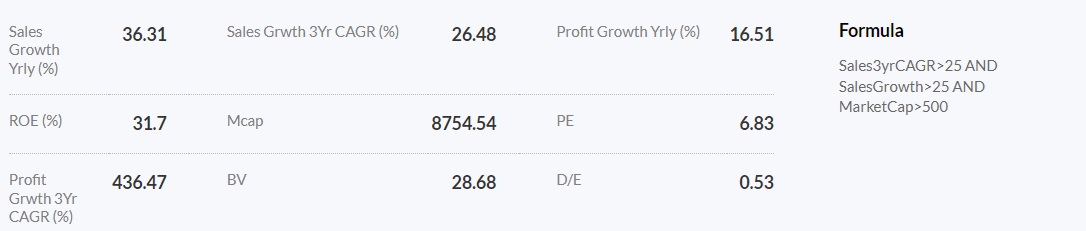

Sales Pioneers

Rising Revenue, Falling Debt | बढ़ता राजस्व, घटता कर्ज

Ujjivan Small Finance Bank Ltd. is a prominent small finance bank in India. It was established to provide a range of financial services to the underserved and unserved segments of the population, including micro, small, and medium enterprises (MSMEs), low-income groups, and marginalized communities.

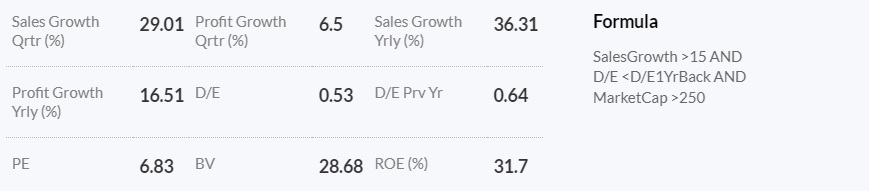

Key Information

- Inception: Ujjivan Small Finance Bank was incorporated in 2017, following the receipt of a banking license from the Reserve Bank of India (RBI).

- Parent Company: Ujjivan Financial Services Limited, a leading microfinance institution, is the promoter of Ujjivan Small Finance Bank.

- Products and Services:

- Savings Accounts: Offers various savings account options with competitive interest rates.

- Fixed Deposits: Provides fixed deposit schemes with attractive interest rates.

- Loans: Includes microfinance loans, housing loans, MSME loans, and personal loans.

- Insurance: Offers various insurance products.

- Digital Banking: Provides internet and mobile banking services for ease of access.

- Branches and Network: Ujjivan has a widespread network of branches across India, focusing on reaching rural and semi-urban areas.

- Vision and Mission: Committed to financial inclusion, the bank aims to empower its customers by providing accessible and affordable banking services.

Corporate Social Responsibility (CSR): Ujjivan engages in various CSR activities, focusing on education, health, and community development.

Achievements:

- Recognized for its contributions to financial inclusion and customer-centric services.

- Achieved significant growth in customer base and financial performance since its inception.

Ujjivan Small Finance Bank Ltd. reported notable financial performance in recent quarters. For Q4 of FY 2023, the bank achieved a revenue of ₹1,764.64 crore, compared to ₹1,363.89 crore in Q4 of FY 2022. The net profit for Q4 of FY 2023 was ₹329.63 crore, up from ₹309.50 crore in the same quarter of the previous year (INDmoney) (Ujjivan SFB).

Additionally, Ujjivan SFB achieved a net profit of ₹1,100 crore for the entire FY 2022-23 (Ujjivan SFB). This growth reflects the bank’s efforts in expanding its reach and enhancing its digital banking services to better serve the unserved and underserved populations across India (INDmoney) (Ujjivan SFB).

यहाँ क्लिक कर के और जानकारी देखे